The $740 billion senior care market is ripe for disruption, but full of challenges

There’s been a lot of interest and activity around senior care in 2016 as investors and entrepreneurs alike consider the path to building a…

There’s been a lot of interest and activity around senior care in 2016 as investors and entrepreneurs alike consider the path to building a significant business in this space. Just one example, Honor raised a $42M Series B led by Thrive Capital, after raising a $20M Series A just one year before led by Andreessen Horowitz.

Is there legitimate cause for investor optimism in senior care? To find out I spoke to founders that are addressing the market and dug into some of the fundamentals of the companies themselves.

Tl;dr: Broadly speaking, the market is huge. Senior care is a $740B market that is ripe for disruption because it still maintains outdated, inefficient processes that haven’t changed in over 40 years in some cases. However, entrepreneurs should keep in mind certain that market dynamics can make it challenging to achieve mass market adoption. Areas that I think are particularly ripe for innovative, large businesses are post-acute transition, remote medical communication, end of life planning, and mental acuity apps.

Why is it interesting?

Not only is the senior healthcare market huge, but it’s also growing quickly.

Not only is this a multibillion market, but also the senior population is growing 20% every 10 years.

In fact, 1 in 5 Americans will be a senior by 2030.

It is a market fraught with outdated and inefficient processes and little or fragmented competition in most segments.

In many segments, there is a real opportunity to improve efficiency with technology and to reduce inefficiencies, for example, by increasing compliance.

In addition, many segments are fragmented. Honor, for example, is attacking the home health segment where today there are 50,000 home health agencies throughout the US.

Seniors want to leverage technology to manage their health.

According to a 2014 Accenture survey, 68% of seniors consider technology to helpful in improving their health and understanding their medications. In fact, 61% are looking for new technologies to use.

These healthcare management products are important because they can promote healthier behaviors, thereby reducing costs and improving outcomes.

So why have we not seen more breakout success?

Seniors are a diverse group, with varying needs and preferences.

Not all seniors are alike. It is important to understand the differences in their use of technology and level of independence. Younger, more tech savvy seniors (65–70) are still independent, while older, less techy seniors (85+) are facing significant health challenges and require in-home help or specialty housing.

This may sound obvious but as a demographic there are enormous differences between say, an active 67 year old who is quite comfortable using Uber and ordering Instacart with those who are in their 80s and 90s and may require in home nursing.

It’s hard.

There are quite a few challenges to growing a large business.

Stigma of services for seniors — Senior focused services limit their addressable markets when they market themselves as “for seniors”. Why use “Uber for seniors” when you can just use “Uber”? The nomenclature can also deter seniors from using a senior-focused service because it makes them feel old.

It’s still early — Today’s tech enabled start-ups are largely focused on keeping seniors independent, however tech savvy baby boomers are only starting to turn 65, and therefore are 10 years away from needing these products.

Limited reimbursements for new products — Cost can be a barrier to adoption. Medicare doesn’t reimburse a lot of these new products and services hence making seniors pay out of pocket. Cost can limit people’s willingness to try a new product/service even if they need or want it.

Competition may make scaling too costly — Several segments such as prescription delivery and wearables are experiencing strong competition with companies using similar business models. With little differentiation, it is not clear who will win and whether the cost of scaling labor and geographic reach will make a meaningful return on an early investment difficult.

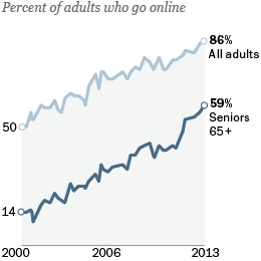

While seniors are increasingly online, this is driven by younger, more independent cohorts.

In fact, 59% of seniors use the internet.

But this trend is driven by younger seniors.

So what are the investment opportunities in this category?

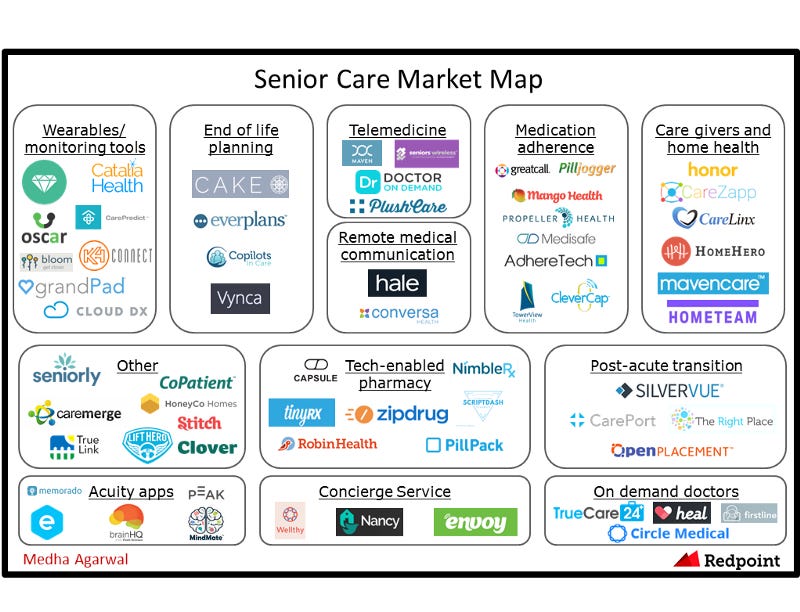

Below is a landscape of the different categories of emerging products and services:

Against this backdrop, there are certain segments that I’m watching closely

Post-acute transition — Often after serious surgery, patients move from a hospital to a temporary care facility for continued care. There is an information gap during the transition process, creating a disconnect between patients, hospitals, and care destinations. A digital solution benefits all 3 stakeholders — care destinations gain a digital presence with marketing and sales, patients get more, better information, and hospitals turn beds more quickly.

Remote medical communication — 83% of patients do not adhere to their care plans and spend $125B on unnecessary office visits. Up to date patient data through a digital communication tool between patient and provider (e.g. an app that a patient can update with vitals and symptoms, as well as chat with a nurse) can improve efficiency and reduce physicians’ per patient costs, which is especially important with the shift to value based care.

End of life planning — $170B is spent annually on end of life care. Increased planning can reduce these costs and improve satisfaction by better tailoring care to patients’ preferences.

Mental acuity apps — Digital brain health is a $3B industry and will double by 2020. High adoption of cognitive acuity apps shows that demand exists, so a product with clinical evidence has the opportunity to gain share. This space is increasingly important as seniors opt to live at home for longer.

And these are areas where I see a lot of potential for entrepreneurs to build interesting companies

Day programs — Day programs provide a destination, activities, and monitoring for seniors. Theses spaces capitalize on the tailwind of seniors opting to live at home longer. Currently, there are only ~4,000 centers in the U.S., which is one center for >15,000 seniors.

Hospice transition & care — The $31B hospice market is fragmented with over 5,500 independent providers. The current matching process is inefficient.

Post-retirement education and work — Seniors are living longer and looking to be entertained and engaged. The e-learning market is $27B in North America and growing ~7% p.a. There is an opportunity for tailored education and work opportunities, but requires differentiated value proposition to avoid risk of senior only stigma.

65+ fashion — Baby boomers are more fit, active, and fashion conscious than ever before. Seniors have buying power and have different buying preferences than Gen X & Y shoppers.

Criteria for success

Overall, I believe that there are 3 important criteria to effectively capitalize on the senior care opportunity:

An effective customer acquisition strategy — to be successful, a company will have to crack the code on how to acquire customers, arguably over having an amazing product (of course, having both is ideal). I’ve seen that scaling the user base in a cost effective way has been a challenge for many companies.

An offering that bridges online and offline — Because many of the seniors who will need services today are 80–85 years old, they are often not very technology savvy. Therefore to be successful, any product or service needs to have an accessible offline component, as well as an online one that their tech-enabled children can engage with.

A proven revenue or cost opportunity — Adding an additional out of pocket expense for seniors and their families at this stage in their lives, when costs are adding up at the same time that many are retiring, is a tough hurdle to overcome. Tapping into existing areas of consumer spend or payer reimbursement is key.

A company that has been effective at each of the above is A Place for Mom. They have been able to reach customers, their families, and shepherd them through the search process to find the right assisted living or independent living facility through the combination of an online product, offline sales, and both online and offline advertising. And because senior living is often an emotionally or physically necessary transition, they are tapping into an existing area of spend but making it easier for both seniors and their families to find the right fit.

While there are certainly challenges in the senior care space, big opportunities exist for entrepreneurs who approach the market systematically and thoughtfully.

If you’re working on an idea in one of the spaces above or have a business model that address the criteria, please reach out. I’d love to learn more!