It's Go-Time for Treasury Management

Back in early January I shared some of my initial thinking around treasury management as one of a few key trends I was planning to dive deeper into this year. With everything that's transpired over the past few weeks, it felt like a good time to take an even closer look at the opportunities on the horizon in treasury and related spaces.

Treasury management has two main roles within an organization. First and foremost is cash and liquidity management. This at the highest level entails making sure the company has enough cash on hand to pay out expenses on a daily basis. This requires monitoring cash flow, predicting cash needs, managing bank accounts, payments, etc. Second is risk management especially around managing FX, interest rates, suppliers and more. A lot of this is extremely manual today. For example, at many small and medium sized companies someone is logging into each bank account every day and manually typing in the daily balance in a spreadsheet in order to track a company’s aggregate cash balance at any given time. Large companies may use solutions like Kyriba as part of their treasury function, but even still this is software that is over 20 years old. For smaller companies, certain products are not even available to them like more complex yield instruments or FX hedging.

Given these responsibilities, there are 3 particularly interesting areas to drive efficiency:

Increase yield in low risk, low lift ways

FX management optimization

Enable access to data and simplify the process required to make cash flow decisions

In today’s market treasury management innovation has meaningful tailwinds - (1) cash and runway being paramount, (2) volatility (3) the cost of inflation and (4) the ability to access meaningful yield in a relatively risk free way.

Said simply, unlike in years past, there is a higher cost and higher risk to suboptimal treasury management.

The chart below starkly illustrates what a dynamic and unprecedented time it is for anyone thinking about money management. Interest rates have risen faster than any other time in the past 35 years, very quickly changing the calculus and opportunity. Operators are now also spending more time on treasury management than they have in a long time -- and with good reason.

On the other hand, as the last few weeks have shown us, this same unprecedented speed of interest rate hikes has caught many seemingly secure financial institutions flat footed. What many thought of as secure financial institutions and instruments turned out to not be. Counteracting the tailwinds I laid out above is an operator's desire to be extremely risk off given what many have witnessed (and perhaps been affected by) in recent weeks.

At the same time, as new commercial banking relationships solidify, smaller companies will have even less access to, and potentially support from, larger institutions because they will likely go from being big fish in a regional pond to small fish in the national one.

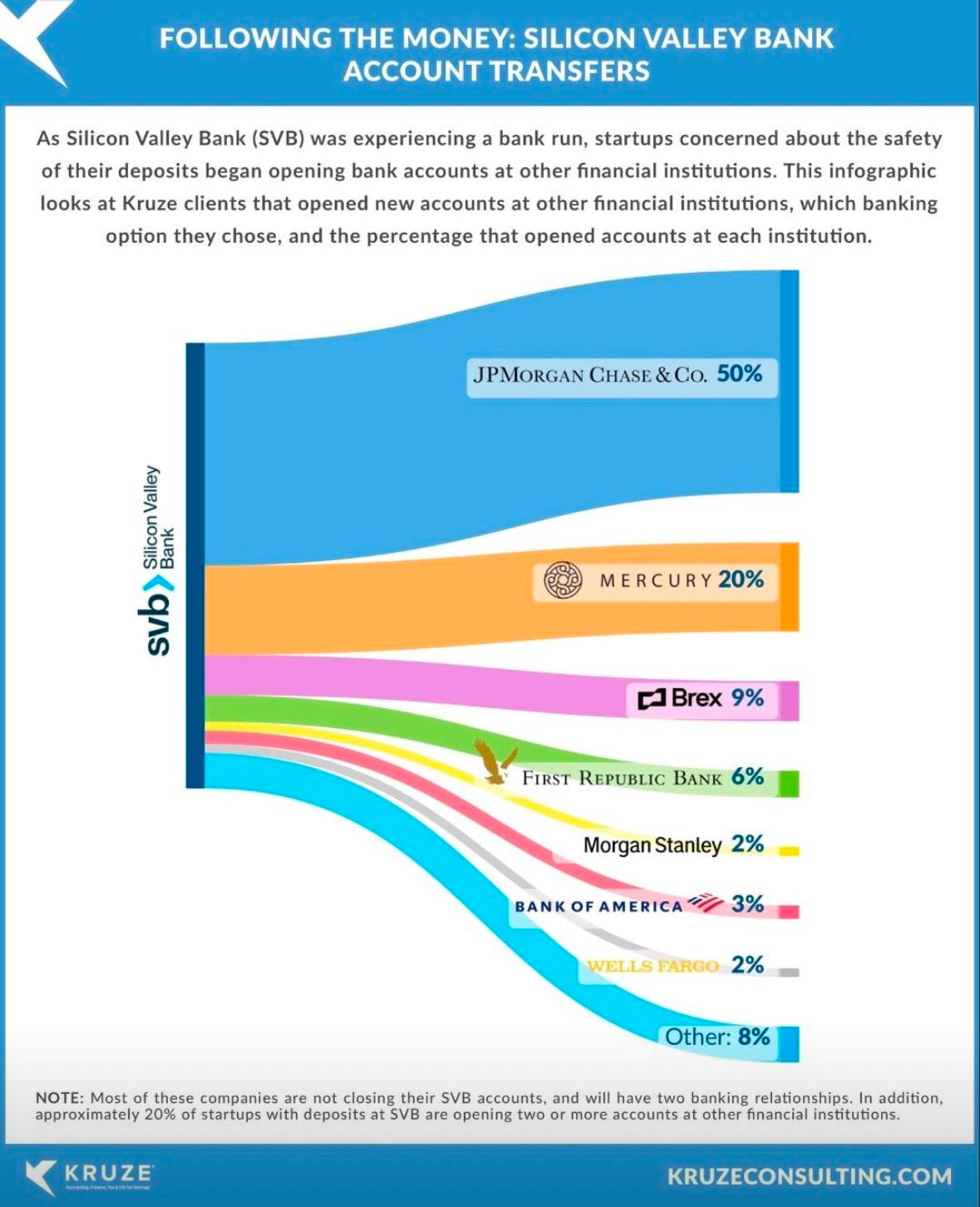

Where does it all net out in terms of customers’ willingness to take a bet on new vendors? 29% of companies diversifying from SVB were willing to bet on venture backed financial services providers like Mercury and Brex in addition to, or in lieu of the top 5 banks.

To me, this continues to signal opportunity as customers are actively reevaluating their current practices and looking for new solutions in ways they have not been in recent years. There are many questions that remain unanswered about how the market will shake out but it's a really interesting time to be building in this space. There are many ways to be successful in this market; my intuition is to start with software and workflows (vs. being directly in the flow of funds from day 1) and expand product offerings from there. Given the macro environment, a broader swath of potential customers will be receptive to purchasing software from a new vendor vs. custodying funds upfront or even talking about money movement at all.

Are you building in this space or have a point of view on opportunities? Drop me any thoughts in the comments or via Twitter (@mkhandel). I’d love to hear from you.